(read time: 3 minutes)

One of the most common questions I get from clients regarding legal residency in Costa Rica is: How much will my CAJA (Costa Rica’s universal healthcare A.K. A. – CCSS) premium cost?

Unfortunately, calculating monthly premiums can be a headache, as the rules often vary from one CAJA/CCSS office or clinic to another. This inconsistency has been confirmed time and again by feedback from my clients who have shared their CAJA/CCSS enrollment experiences with me.

To get a clearer understanding, I personally visited several CAJA/CCSS offices in rural areas as well as the main enrollment offices in downtown San José, directly across from the CAJA/CCSS headquarters. I encountered at least three differing interpretations of how CAJA/CCSS premiums are calculated for various residency categories—Pensionado, Rentista, and Inversionista.

After scheduling a face-to-face meeting with them, I went directly to the management team of the San José CAJA/CCSS office. They were very accommodating, though it was clear they were shocked by the inconsistencies I had encountered, both at rural CAJA offices and with intake staff within their very own San José offices.

After opening and reviewing the policy manuals in front of me, with furrowed brows, they firmly clarified the official rules for how CAJA premiums are calculated.

This is what I was told:

Pensionado:

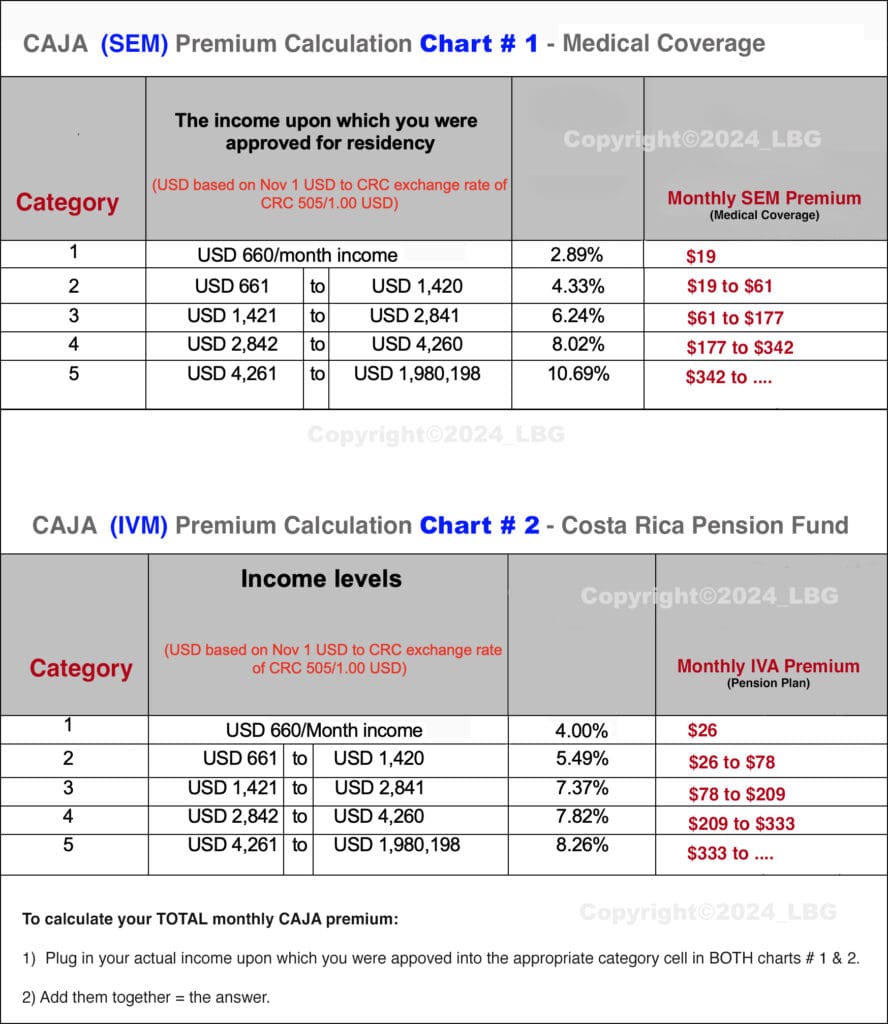

The monthly CAJA premiums are based on the pension income reported to the DGME (Costa Rican Immigration) as part of your residency application. This reported income is then applied to two separate charts: the Healthcare Chart (for calculating the healthcare premium) and the Costa Rican Pension Chart (for determining the pension premium). Those two are added together, and that sum is your total monthly CAJA premium to be paid.

(See the charts below).

Note:

For the majority of applicants, Pensionado will result in the lowest premiums. (not Inversionista). So if you can choose between applying as Pensionado or Inversionista – IE, you have a pension, lifetime annuity, or combination of each, totaling at least USD 1,000/month – then apply for Pensionado residency. For some reason, many applicants with such a choice insist on going with Inversionista—something to do with pride of ownership that subordinates the hard math below, favoring Pensionado.

Pensionado is on average, the least intrusive and the least costly category to apply for and to maintain.

Note:

Officially, Pensionados are not allowed to deduct monthly expenses as a means to lower their reported net income for CAJA premium calculations. However, in practice, CAJA staff at most offices across the country have often allowed these deductions. If they offer it, take advantage of it—but be aware that this is not the official policy.

Rentista:

For Rentista applicants, the monthly CAJA premium is based on the net income of USD 2,500 per month, as stated in the Proof of Income document (either a bank letter or CPA letter) submitted with your residency application to the DGME (Costa Rican Immigration). This income figure is applied to two separate charts: the Healthcare Chart (for calculating the healthcare premium) and the Costa Rican Pension Chart (for determining the pension premium). The amounts from both charts are then added together to calculate your monthly CAJA premium. This combined total is the amount you will be required to pay each month.

(See the charts below).

Inversionista

Premium calculations will be based on your net income, which CAJA will determine by reviewing the most recent three months of Costa Rican bank statements – OR – a statement from a Costa Rican CPA (certified public accountant) detailing your income and expenses – plus – an affidavit affirming the accuracy of this information.

Important Note:

If your income is documented through bank statements from your home country outside of Costa Rica, you will need to provide a Costa Rican CPA statement. The CPA will review your foreign bank records and possibly other income records and base their CPA statement on that information.

Additional Note:

Inversionistas approved for legal residency through an active corporation will also be subject to a personal, on-site audit as part of the premium determination process. (An active corporation is one that earns income, reports that income, and pays taxes on that income.)

(See the charts below).

Q & A:

- What do I do if I think the CAJA office I am trying to enroll at is not following the proper procedure?

Show them the DGME (CR Immigration) Resolución, which clearly outlines the requirements. - Can I change my current Rentista status to Pensionado to negotiate my way down to a lower monthly CAJA premium?

Yes. - After my first three years of temporary residency, I apply for and obtain Permanent Residency. Will that also provide me an opportunity to renegotiate my monthly premiums?

Yes. With a Costa Rican CPA letter of income and expense. The net monthly income amount must be significantly less than the monthly income used to calculate your current monthly premiums initially. - What about the part of CAJA premiums paid into the Costa Rica Pension Plan?

That is a separate issue and is being worked on. Patience. It will be rescinded. IE: Cart # 2 will no longer apply.